Springtime signals renewal—a perfect opportunity not only to clean your home but to tidy up your finances as well. Add these tasks to your list to refresh your financial life and ensure you’re on track to meet your goals.

1. Polish Up Your Goals

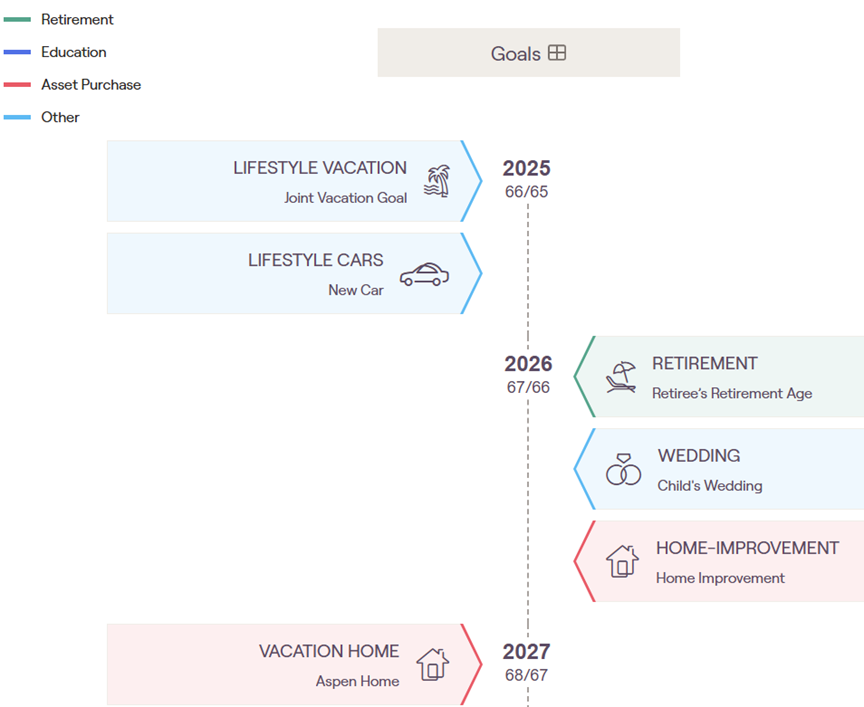

Take some time to review your significant financial goals such as retirement, college savings, or preparing for a major purchase like a home or vehicle. Are you making progress toward these targets? Reflect on your shorter-term objectives for the year as well, such as saving for a family vacation or a home renovation. Does your current strategy remain effective or does it needs updating?

Source: Right Capital

The above graphic is a visual presentation of goal planning in our financial planning platform

2. Declutter Your Budget

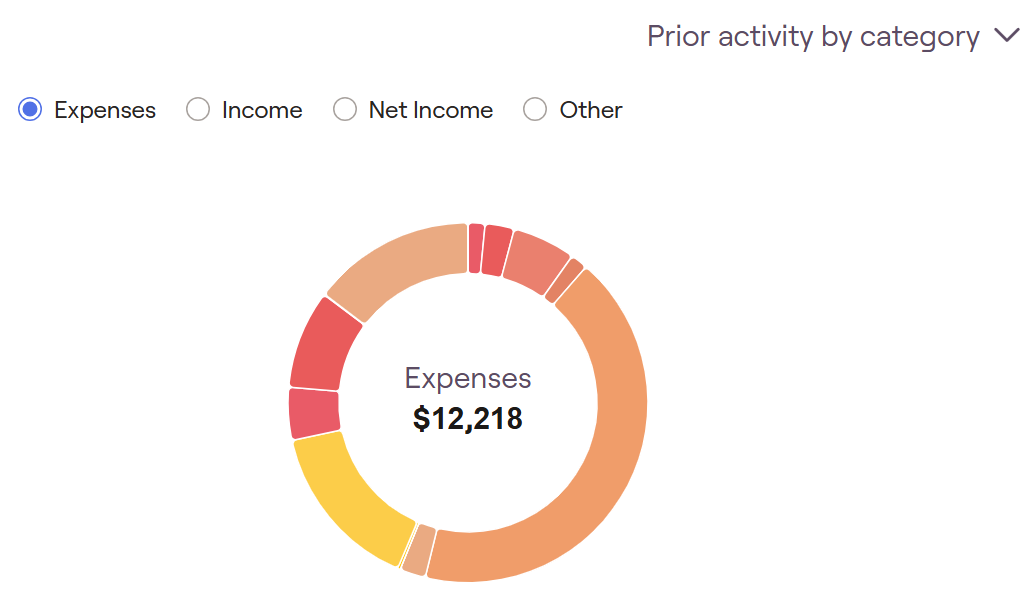

Refreshing your budget is a great way to build good habits for the rest of the year. Analyze your spending habits over the past year. Where did you encounter challenges or overspend? Are there subscriptions or services you no longer use? Trimming unnecessary expenses helps streamline your budget and lets you re-allocate spending towards your priorities. Learn more about how to create a realistic budget here!

Source: Right Capital

The above graphic shows the budgeting tool available in our financial planning platform

3. Dust Off Your Financial Plan

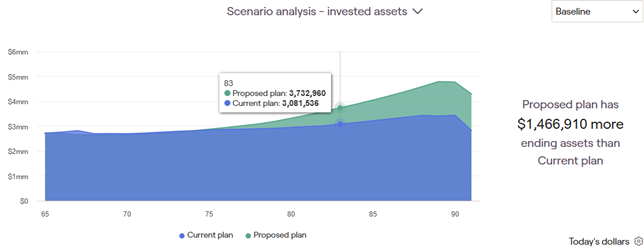

Assess your overall financial plan to track your progress. Take the time to review your financial milestones, noting where you have succeeded and where improvements could be made. Are there adjustments needed in your plan? Proactive adjustments such as increasing your contributions if you have extra cash, or reducing distributions if you’re spending down your retirement accounts quickly can have significant effects on your long-term plan. If you do not currently have a financial advisor, consider engaging one to provide a professional review. If you’re already working with an advisor, make sure they understand your latest financial objectives.

Source: Right Capital

The above graphic shows a scenario analysis chart for a retirement plan

4. Spruce Up Your Estate Plan

Ensure your estate planning documents, including your Will or Trust, are current. Significant life changes, such as marriage, divorce, births, deaths, or significant financial shifts, should prompt updates to these documents. Pure Portfolios has partnered with Estately to produce Will and Trust documents. Click here to learn more!

5. Get Your Annual Credit Report

Obtain a free annual credit report from each of the three major credit bureaus—Experian, Equifax, and TransUnion—by visiting AnnualCreditReport.com. Checking your credit report yearly can help detect potential errors, unauthorized activities, or identity theft.

Adding these steps to your financial spring cleaning can help you regain some clarity, sharpen your financial focus, and get you in a good position to achieve your goals this year. Start today, and feel free to reach out to your advisor if you have any questions!