“The higher returns to quantitative investing accrue from the abnormally bad behavior of humans at times of crisis.” – Dan Rasmussen, author of The Humble Investor

The past few weeks have created a cloud of uncertainty for investors. We’ve collected several frequently asked questions from Pure Portfolios clients & prospective clients.

We hope this provides some clarity on the current environment and range of potential outcomes.

*Usually, this note would go to Pure Portfolios clients. We want to share with everyone to help folks make sense of what’s happening*

Will tariffs cause a recession?

Recessions are darn near impossible to predict with a high error forecasting rate. Recessions aren’t a tangible thing you can point to. Economists can’t agree on what data points officially designate a recession. It’s one of those things you know when you see it. Our simple definition of a recession is a change in consumer/business risk appetites.

For example, my neighbor wants to put in a new deck. I spoke to him yesterday and he’s going to put off the project. My wife and I were going to do some work on our house. We will probably wait now. These types of micro-decisions to pull back or postpone spending, multiplied by millions (or billions) of households, can lead to a recession.

One could argue the scale and speed of the tariff implementation are seen as major factors that could severely disrupt consumer & business risk appetites. Not many businesses are looking to hire, allocate capital, or start new projects in this environment (especially if they source goods, raw material, etc. from abroad).

Things could change in one tweet.

Trade deals could be reached.

Countries could aggressively retaliate.

The range of potential outcomes is quite wide, but the longer this goes on, the higher the likelihood of a recession.

Has the U.S. been taken advantage of?

In some areas, yes.

The U.S. auto industry has faced significant challenges due to global trade, including subsidized imports and barriers to U.S. exports. Some auto analysts note that the U.S. auto industry may not have survived without the ability to outsource production to other countries.

U.S. agricultural and seafood exports have faced barriers and tariffs in foreign markets, costing the industry hundreds of millions in lost export potential.

However, in some industries trade deficits are a good thing. For example, Vietnam can make garments cheaper, faster, and better than U.S. manufacturers. Further, a non-desirable, low wage job in the U.S. might be a coveted, high paying job elsewhere. The supply of labor is not only cheaper, but more abundant in emerging economies.

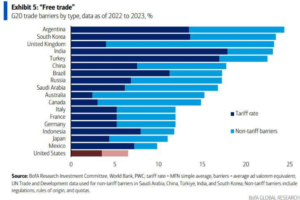

Source: BofA Global Research

The above graphic shows trade barriers by type (2022-2023) for the United States’ biggest trading partners. The United States (red) has the least amount of trade barriers relative to G20 countries.

The United States is the richest country in the world. We are the biggest consumers on planet Earth spending like drunken sailors. Eliminating or reducing tariffs is one thing; trying to eliminate trade deficits with every country is fantasy.

What is a trade deficit?

A trade deficit occurs when a country’s imports of goods and services exceed its exports. Simply, it means a country is buying more from other countries than it is selling to them.

The U.S. has consistently held an overall trade deficit since 1976, including a $1.2 trillion trade deficit in 2024. The two largest U.S. trade deficits are with China ($263.3 billion) and Mexico ($179.0 billion).

A trade deficit is not necessarily good or bad; it simply reflects the fact that the U.S. is a consumption-based economy with strong domestic growth and purchasing power.

What is Pure Portfolios doing to protect my investments?

We reduced risk during the week of 3/31 by selling equities and adding to fixed income. This is part of our monthly screening process which puts every asset class our clients own through a series of rules. The output guides our risk exposures (which assets to buy, sell, or hold).

This is an important function of our investment process, but the real work is building appropriate, risk-aware portfolios before a market event happens (most investors have no clue how much risk they are taking until it’s too late).

Many investors tend to take more risk than they set out to when times are good, market tanks, and they try and make a bunch of changes (usually panic selling) to avoid losses.

This is a time-tested way to destroy wealth and drive yourself crazy.

In our opinion, good investing is being candid and honest about your investment personality and capacity for risk. Then, building a diversified, risk-aware portfolio that you can stick to when the inevitable market decline comes.

Do tariffs cause inflation?

Again, it’s complicated.

According to the Federal Reserve Chair Jerome Powell, the tariffs are “likely to cause inflation to rise and could be persistent.”

JPMorgan Chase economists estimate that the tariffs could drive up overall inflation by 2.3% this year alone, including a 2.8% increase in food prices and an 8.4% jump in automotive prices.

The Federal Reserve Bank of Boston estimates that the new tariffs could add a minimum of 0.5% to core inflation, depending on the response of suppliers, businesses, and consumers.

While tariffs might be inflationary, they might not be.

Per my earlier comments, consumers and businesses are likely to delay or eliminate spending given the economic uncertainty. That’s not inflationary.

When the market sells off, people feel less wealthy which means they are less likely to spend. Former Federal Reserve Chairman, Ben Bernanke coined this phenomenon the “wealth effect.” Bernanke found that the collapse in asset prices, including stocks and real estate, contributed to the severity of the economic downturn by reducing consumer spending. Again, not inflationary.

The wildcard is how humans change their behavior. It’s a minority opinion, but there’s a faction that says tariffs could be deflationary (prices come down).

Anthony Pompliano, CEO of Professional Capital Management, thinks tariffs are deflationary…

“There are many reasons why prices end up going down. Tariffs don’t operate in a silo. For example, Walmart is already telling suppliers they must eat the cost of tariffs and the large retailer says they are not going to pay higher prices for those goods. This shows that American companies have the leverage to squeeze the foreign companies, rather than be forced to pass higher prices on to customers.”

It’s easy to predict inflation on paper. Predicting changes in consumer behavior in real-time is futile.

What are your predictions for how this ends?

We don’t make predictions, but you would have to believe the longer this goes on, the more external pressure gets exerted on current trade policy.

- Most business owners aren’t going to be happy with a cloud hanging over supply chains.

- Investors aren’t going to be happy with tanking markets.

- Politically, tanking markets, potentially higher inflation, an economic slowdown are not good for incumbents come mid-term election time.

- Other countries, allies & hostile, could boycott U.S. goods & services.

This external pressure might lead to a compromise, softening rhetoric, or new trade deals. I don’t know how it ends, but in my opinion, tariffs won’t be front page news in 6-12 months.

Why did markets sell off so aggressively when tariffs have been talked about for months?

Market participants were expecting modest tariffs. The reality was a tariff bazooka.

When expectations and reality are miles apart, you get massive moves in financial markets.

Volatility occurs when expectations and reality are wildly different. The crazy swings are markets pricing in updated expectations.

What makes navigating markets so tricky is it can swing the other way too. On 4/7, there was a rumor that the tariffs would be paused 90 days and stocks rallied aggressively. This reversed quickly as the rumor was shot down by the current administration.

*This blog was drafted on 4/8. On 4/9, President Trump issued a 90-day tariff pause and markets rocketed higher. The massive adjustment was expectations clashing with reality once again, this time in investors favor.*

Should I sell stocks?

If someone is itching to sell during a tough market, it’s usually a combination of the following…

- Taking too much risk emboldened by two years of strong equity market returns

- Do not have a framework for making buy/sell decisions instead relying on emotion or gut instinct

- Sucked into the doom loop of the 24/7 news cycle

- For retirees, failed to downshift from wealth building to keeping wealth mindset (See “Retirees: More is the Enemy of Enough“).

- Miscalculated risk tolerance

- Pattern of emotional behavior during difficult markets

In our experience, the undisciplined, over-levered, and short-term oriented panic, while the patient, un-levered, and long-term oriented feel nothing.

We empathize that it’s a scary environment right now. No one wants to see the market tank. Nor is there a road map or historical precedent to how this episode ends. We understand it’s impossible to escape the endless headlines of how the world is going to hell in a hand basket.

We encourage clients to stay plugged into Pure Portfolios’ email communications and Sunday Coffee Reads newsletter. Last week during peak carnage, we sent three client communications; what portfolio adjustments we were making, our opinion on tariff volatility, and how to ensure your retirement plan can hold up during a tough market.

If your advisor is telling you to “stay the course” and you want a more proactive approach to managing portfolio risk, click here.