“Bonds as an asset class will always be needed, not just by insurance companies and pension funds, but by aging boomers.” – Bill Gross, retired founder of PIMCO

It’s an 800-pound gorilla. The biggest asset class in the world (and the most complex).

The oldest form of borrowing and lending goes back 4,000 years.

It’s had a rough go the last three years, posting one of the worst stretches in history.

Many investors have shunned the asset class. Others have called it dead.

Salespeople have used the opportunity to pitch exotic, high fee alternatives.

We wrote the original version of this post April 14th, 2022, “Does it Still Make Sense to Own Bonds?”, amid peak chaos.

Our conclusion from two years ago was a resounding “yes”, with the caveat that poor bond returns can lead to higher future bond returns.

Let’s revisit the most unloved and misunderstood asset that unpins the global economy.

Diversification Qualities are Back

The most uncomfortable part about higher interest rates and higher inflation is most asset classes do poorly, including bonds (see 2022). When rates and inflation trend lower, the diversification qualities of bonds tend to shine.

Despite calls that the world is abandoning U.S. Treasuries (more on that later), high quality government & corporate bonds have held up well in 2025…

Source: Koyfin

The above chart shows year-to-date (as of 4/23/25) performance for short-term U.S. Treasuries (SCHO, purple), intermediate U.S. Treasuries (SCHR, orange), short-term corporates (SCHJ, green), and intermediate corporates (LQD, yellow). High quality fixed income has done well to mitigate downside movements in stock prices (SPY, S&P 500).

Bonds have historically played an important role in a diversified portfolio, providing income, stability, and potential for capital appreciation if rates decline.

Fixed Income (Finally) Has Income

On 12/31/2021, the 1-year U.S. Treasury bond yield was 0.39%. The low-rate environment punished savers, retirees, and anyone looking to generate investment income from their portfolio.

As of 4/23/25, the 1-year U.S. Treasury bond yield is 4.029%. The current environment is a great development for savers and retirees looking to generate income without taking a boatload of risk.

Further, historically starting yields are a great predictor of future bond returns. According to Bloomberg, there’s a 95% correlation between the starting 10-year yield and annualized bond returns. If precedent holds, that means future annualized bond returns could be ~4.3% per year (for the next 10 years).

Demand for Cash Flow Predictability

According to Alliance for Lifetime Income, in 2025, ~11,400 Americans will turn 65 every day. In total, 4.18 million people will turn 65 this year, the highest on record.

Further, pension funds, insurance companies, endowments, etc. must match their assets with liabilities. Large pools of institutional capital rely on the safety & soundness of bonds to meet their short-term obligations.

The Securities Industry and Financial Markets Association (SIFMA) estimated the global bond market to be worth $140.7 trillion at the end of 2023, compared to the $115 trillion global equity market.

Aging domestic (and global) demographics and the need for cash flow predictability should provide a tailwind to bond demand. The oldest form of finance, borrowing & lending, isn’t going anywhere.

The “R” Word

We get asked multiple times a day how we are going to react to a recession. Predicting recessions is darn near impossible (see “The Recession that Never Came.”).

Rather than trying to predict when a recession will occur, it’s better to accept most everyone will feel pain in a recession. Our focus should turn to actionable steps to mitigate damage.

Historically, bonds have been a good place to be.

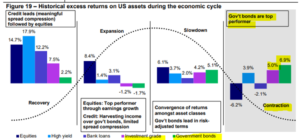

Source: Invesco

The above graph shows which asset classes performed the best during every economic contraction since 1970 (far right). It would seem high quality fixed income, government & investment grade corporate bonds (pink & green bars), performed nicely during previous economic contractions.

Are U.S. Treasuries Still a Safe Haven?

The death of U.S. Treasuries is wildly exaggerated. Look no further than the positive year-to-date returns of various U.S. Treasury maturities.

The reserve currency status of the U.S. Dollar and the safety & soundness characteristics of U.S. government bonds could change over time. However, these are changes that occur over decades, not years.

When the stuff hits the fan, global investors still want to own high quality, liquid, and stable U.S. assets.

The calls for the end of the Dollar and U.S. government bonds is nothing new. The narrative seems to flare up every few years or so.

In the spring of 2023, the absurd narrative of the dollar losing its reserve currency status was all over mainstream media.

From our 4/20/2023 post, “The Demise of the U.S. Dollar,”…

“The U.S. dollar was involved in nearly 90% of global foreign currency (FX) transactions, making it the most traded currency in the world. Notice how stable the dollar’s transaction volume (red) has been over the past 20 years.”

It turns out, U.S. dollar demand had never been higher as a percentage of global trade.

We can’t say which bond portfolio is right for you, but here’s what we would avoid…

- Extra long maturities

- Reaching for “too good to be true” yields

- Overexposure to lower quality corporate and municipal bonds

- Buying exotic instruments you don’t understand

In our opinion, the merits of bonds as a diversifier, income source, portfolio hedge, and safe haven still hold true. The most unloved and misunderstood asset that unpins the global economy isn’t going anywhere.

If you need help building a tax-efficient, risk aware, and intentional bond portfolio, shoot us a note at insight@pureportfolios.com or click here.