“Everybody talks about tariffs as the first thing. Tariffs are the last thing. Tariffs are part of the negotiation. The real trick is going to be increase American exports. Get rid of some of the tariff and non-tariff barriers to American exports.” – Wilber Ross, former U.S. Secretary of Commerce

A popular narrative, which is spouted off as a fact, is that tariffs are going to cause inflation. I’ve seen it stated as a certainty in analyst notes, market commentary, and talking heads on financial TV.

Everyone seems to think tariffs will be inflationary. In my experience, that’s a bit too neat & tidy.

On one side, President elect Trump wants to roll out wide sweeping tariffs to generate revenue and create competitive trade deals for the United States.

Critics counter that tariffs are inflationary, with the U.S. consumer bearing the brunt, which could lead to a potential trade war.

The whole equation is being politicized which can lead to misinformation, exaggeration, and fear mongering.

We unpack everything you need to know about the history of tariffs, who pays for tariffs, what happened during previous periods when tariffs were implemented, and complex relationship between tariffs and inflation.

What is a Tariff?

A tariff is a tax or duty imposed by a government on goods or services imported from another country. The main purposes of tariffs are:

- Protecting Domestic Industries: Tariffs make imported goods more expensive, encouraging consumers to buy domestically produced products instead. This can help safeguard jobs and stimulate the growth of domestic businesses.

- Generating Revenue: Tariffs provide an important source of income for governments, particularly in countries where other forms of taxation may be limited.

- Mitigating Trade Imbalances: Tariffs can be used to discourage imports and encourage domestic production, helping to reduce trade deficits between countries.

- Retaliating Against Unfair Trade Practices: Tariffs can be imposed as a countermeasure against foreign countries that are engaging in unfair trade practices, such as subsidizing exports or dumping products at artificially low prices.

The History of Tariffs in the United States

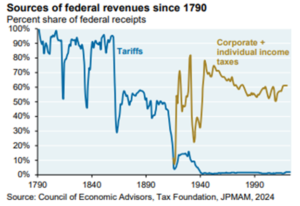

Prior to the introduction of the federal income tax in 1913, tariffs accounted for up to ~95% of the federal government’s revenue at times. For well over a century, the federal government was largely financed by tariffs, averaging about 20% on foreign imports.

The dependence on tariff revenue subsided with the ratification of the 16th Amendment in 1913, which gave Congress the power to collect income taxes.

What’s the Current Tariff Landscape?

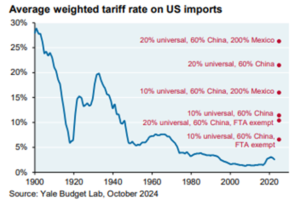

Virtually non-existent compared to the 1800’s & early 1900’s…

The above chart shows the baton pass between tariffs (blue) and corporate & individual income taxes (gold). Today, tariffs are a miniscule source of revenue for the U.S. government.

The above chart shows which countries (or country) is the target of tariffs for U.S. imports. It’s no surprise China has been the primary target of U.S. tariffs.

Who Pays for Tariffs?

The biggest misconception (often fed by political rhetoric) is that the exporting country pays for the tariff. The importer, either a company or individual, directly pays the tariff to the government. The cost of the tariff has the potential to be shared by businesses and consumers throughout the supply chain.

The economic burden of the tariff often extends beyond the importer. Importers, in this case, a U.S. company has the potential to incorporate the tariff cost into the price of the goods they sell to wholesalers, retailers, or consumers.

Whether this is inflationary or not also depends on consumer preferences and behaviors.

Do Tariffs Cause inflation?

Let’s say a good is too expensive due to a new tariff. Consumers can buy different, cheaper products. Companies can mix up their supply chains to provide the same goods at a competitive price. This is where there is no clear answer regarding whether tariffs are inflationary or not.

The global economy is a complex system, it’s not a stretch to say there could be inflation in some industries while others are unaffected by the implementation of new tariffs. The scope of the tariffs, the flexibility of supply chains, and the broader economic environment all factor into the equation.

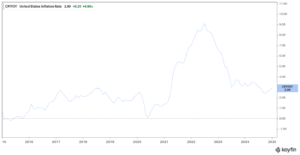

Let’s look at what happened to inflation during President Trump’s first term (2016 – 2020)…

President Trump rolled out several new tariffs during his first term including 25% tariffs on Chinese goods, 30-50% tariff on imported solar panels and washing machines, 25% tariff on steel, and 10% on aluminum.

Source: Koyfin

The above chart shows U.S. inflation from 2016 – 2025. From 2016 – 2020 (President Trump’s first term), his tariff policies had a minimal impact on broad inflation.

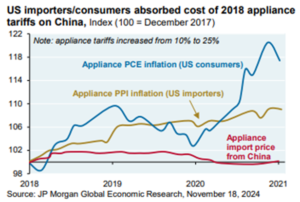

However, tariffs did impact washing machine inflation…

The above chart shows appliance inflation from 2018 – 2021. It seems U.S. companies and consumers paid higher prices due to tariffs. This is consistent with our early comments, tariffs will have an impact on certain industries, but that doesn’t necessarily mean widespread inflation.

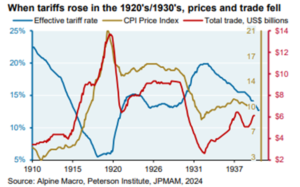

Finally, we examine 1920 to 1930 when tariffs rose substantially…

The above chart shows the effective tariff rate (blue), consumer price index (CPI inflation measure), and total trade measured in U.S. dollars. It’s not an apples-to-apples comparison to modern day, but inflation and total trade decreased when tariff rates went up.

The takeaway is that neat and tidy narratives such as “tariffs are going to cause inflation, it’s a certainty,” are misguided.

The global economy is a complex system with millions of ever-changing variables. In the wise words of Bob Farrell, when everyone agrees, something else happens.