“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” – Peter Lynch, famous investor.

You’re sitting on cash. Maybe you sold near the bottom and watched the market scream higher. Maybe you have been waiting for the perfect opportunity to buy stocks, only to be paralyzed by a logic-defying rally. On one side, you want to get invested (or reinvested). It’s no fun to watch the market bounce back and not participate. On the other hand, you are worried that as soon as you reinvest, the market will take a nosedive.

During the first half of 2020, we’ve seen variations of the above scenarios. Here’s a few ideas to invest cash in a runaway market, ranging from simple to nuanced.

Just Do It

Build a portfolio that fits your acceptable range of outcomes. Get 100% invested today. Focus on the most important things in your life. There’s beauty in simplicity.

Dollar-Cost Averaging

Investing cash in one large chunk might not be for everyone. Dollar-cost averaging is a viable option:

Dollar-cost averaging (DCA) is an investment technique of buying a fixed dollar amount of an investment on a regular schedule, regardless of the share price. The investor purchases more shares when prices are low and fewer shares when prices are high. (Source: Investopedia)

For example, if we have $100,000 in cash, a dollar-cost averaging program could have us investing $20,000 per month over the next five months. You can play with the dollar amount and time frame for getting reinvested. The premise is to create a systematic approach to getting fully allocated regardless of stock market price movements.

For more reading, check out “Does Dollar Cost Averaging Work?”

Strategic Approach

Not all market rallies are equal. There are usually leaders and laggards. This time is no different:

Source: Bespoke Investment Group

The above graph shows year-to-date S&P sector performance (as of 6/9/20). Notice the majority of sectors are still in the red for the year.

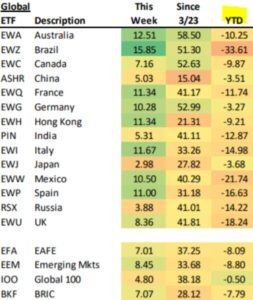

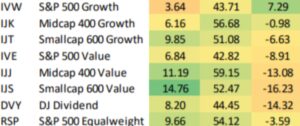

Source: Bespoke Investment Group. Returns as of 6/5/2020 market close.

The above chart shows various country specific ETFs, various market cap indices, and global benchmarks. Global markets have participated in the runup from the bottom, but still trail the S&P 500 year-to-date.

We are not advocating blindly plugging in cash to the worst performing assets. However, the bargain hunter might find value in areas of the market that are still relatively depressed. Obviously, the strategic approach to investing cash is more advanced. We would encourage investors to set up selection criteria or get the help of a professional investor.

Risk-Based Approach

The risk-based approach fully invests the “safe” asset classes first. We should note this only applies to investors with multi-asset class portfolios, namely fixed income or bonds. Let’s say we are building a 60% stock/40% bond portfolio, we would fully invest the fixed income immediately. For the riskier assets (stocks), we would essentially use a dollar-cost averaging approach. We would be more aggressive with purchasing beaten down areas of the equity markets. For example, in today’s market environment, we would be targeting international, small cap, emerging markets, energy, industrials, etc. We would be less excited about plowing money into U.S. large cap stocks.

Notice how none of these strategies have anything to do with market timing or index price levels. I’ve heard investors say things like “I’m waiting for a 20% correction before investing in stocks.” Either the correction never comes and the market keeps going higher or the correction does come and the investor freezes, convinced the damage will get worse.

The best approach of all is build a portfolio that you’re comfortable with and stick to it when things inevitably go bad.

For more information about Pure Portfolios’ investment philosophy, check out the Q&A feature in CityWire Magazine.