“Oh, Monte Carlo, I’ve done that. It’s worthless!”

“This simulation is the greatest thing ever!”

“I don’t know what I’m going to do. I’m waiting for my insurance person to finish a Monte Carlo analysis for me.”

When it comes to Monte Carlo simulations, I’ve heard it all.

Which is it, worthless or worthwhile?

This is an important question, as many folks rely on Monte Carlo outputs to frame their retirement expectations.

We review the benefits and pitfalls of Monte Carlo analysis and how you can refine the exercise to get the most out of your financial plan.

First, some context.

The Monte Carlo method was invented by Stanislow Ulam, a Polish-American scientist that worked on the Manhattan Project. While recovering from brain surgery, Ulam took an interest in the card game solitaire. He was particularly interested in plotting the outcome for each game (distribution of outcomes) and the probability of winning (source: Investopedia, Wikipedia).

A Monte Carlo simulation is a model used to predict the probability of different outcomes by changing a random variable and running hundreds, thousands, or millions of trials.

In financial planning, the random variable is market returns. For climate change, the random variable might be temperature. To measure structural damage after an earthquake, the random variable might be magnitude.

By tweaking the unknown variable and running many different simulations, we should better understand risk and the potential range of outcomes. If we were to run one simulation, relying on a single occurrence, we might understate or not fully understand risk.

Here are two Monte Carlo examples from hypothetical financial plans…

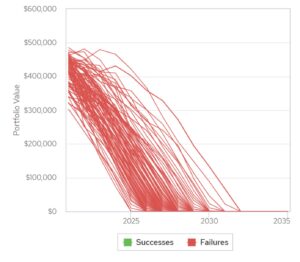

Source: MoneyGuide Pro

The above is a hypothetical financial plan showing various portfolio values after 1,000 trials. Each line represents a trial and randomly assigns a rate of return. We can conclude that most scenarios show the plan running out of money between 2025 and 2030. If market returns are unusually high, the plan stretches out beyond 2030 for a few scenarios. In this case, even the best market returns will not make this financial plan favorable.

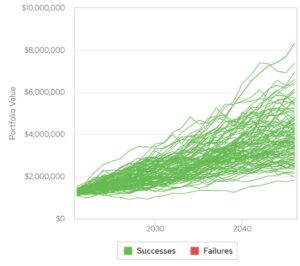

Source: MoneyGuide Pro

The above financial plan has a much more favorable result, after running the same Monte Carlo simulation. Even a series of poor market returns should not derail this hypothetical financial plan. This is an empowering position to be in; a favorable plan regardless of what financial markets are doing. In this case, even the worst market returns might not derail this plan.

The benefits of Monte Carlo, in the context of a holistic financial plan, should be clear. It helps us better understand risk and the range of potential outcomes. If done properly, Monte Carlo may give a retiree or investor peace of mind that they’re on the right track.

Here’s where Monte Carlo analysis falls short…

- Monte Carlo assumes everything in your life today i.e. income, expenses, risk tolerance, asset allocation, health, and goals stay the exact same through time. The variability in the individual trials comes from changing the return assumptions on your investment portfolio. You should be running a new Monte Carlo every year to reflect your current reality.

- Monte Carlo does a poor job of modeling extreme market events or “Black Swans.” The return assumptions are often based on a normal return distribution, which means capturing 95% of all historical investment outcomes. The remaining 5%, or tail events, are often omitted which could understate the range of possible outcomes. The COVID sell-off of 2020 and the 2008-2009 Financial Crisis would be examples of extreme tail events that a typical Monte Carlo simulation would not capture.

- Monte Carlo doesn’t properly capture return sequence risk. Consider two degenerate gamblers flipping a quarter for $100 per flip. One of the gamblers has heads and the other has tails for the duration of the game. If it lands on tails 10x in a row, the unlucky gambler with heads might be bust before the math evens out. This is sequence risk in action.

- An investors portfolio could achieve a negative 10% return for 10 years in a row while taking sizable portfolio distributions. The double hammer could impair a capital base to the point of no return.

- Monte Carlo can be used as a tool by financial advisors to sell stuff you don’t need. I recently spoke to a prospective client about an insurance agent running a Monte Carlo plan for his upcoming retirement. I warned him not to be surprised if the plan is “unfavorable,” only to be rerun by the agent with an annuity or whole life insurance policy. The plan would likely turn magically favorable to bolster the chances of a sale.

- Monte Carlo overemphasizes the role of investment returns within the financial plan. While building the proper portfolio is important, lifestyle and expenses are the biggest influence on a plan’s success or failure.

Monte Carlo analysis is a great tool if utilized properly. It helps a retiree understand risk and range of potential investment outcomes. However, the exercise has its limitations and blind spots.

We believe a good financial plan should create a margin of safety. Allow for randomness, surprises, poor market returns, etc.

In other words, plan on your plan not going according to plan.