“We are going to be broke really quickly unless we get serious about dealing with our spending issues.” – Paul Tudor Jones, hedge fund manager

We’ve been asked all sorts of questions relating to how to position investment portfolios in lieu of the election results.

In our opinion, mixing investing and politics is a recipe for disaster. While the presidential election results have short-term impact, markets tend to move on rather quickly.

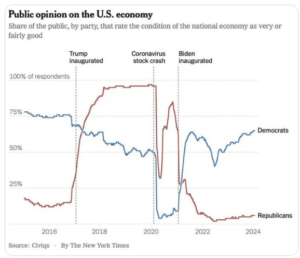

Most importantly, anything that adds emotion into the investment process clouds rational thought. Look no further than how public opinion on the U.S. economy ebbs and flows with which party is in charge…

Source: Civiqs

The above chart shows public opinion on the U.S. economy by party (blue Democrat, red Republican) after presidential elections. Notice how wildly economic opinions swing depending on which party is in the White House!

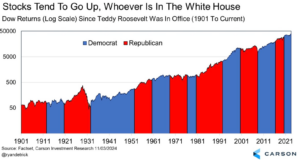

Meanwhile, U.S. stocks keep chugging along regardless of which party wins the Presidency…

Source: Carson Investment Research

The above graph shows the Dow Jones Industrial Index from 1901 to 2024. Politics aside, the U.S. stock market has been a juggernaut regardless of which party is in office.

Rather than spinning wheels about what’s going to change post-election, a better question is what’s NOT going to change over the next 5-7 years (read more about this thought exercise here)?

In our opinion, bursting government deficits, debasement of the U.S. dollar, and sticky inflation are here to stay (these three themes are very intertwined).

What should an investor consider owning given this secular backdrop of higher inflation, reckless government spending, and a loss of purchasing power?

Stocks

Most people don’t think of stocks as a hedge against inflation.

Source: Charlie Bilello, Creative Planning

The above graph makes a darn good case for U.S. stocks (measured by the S&P 500, blue) as a hedge against inflation and maintaining purchasing power (red, purchasing power of the U.S. dollar). While stocks can be risky in the short-term, over long periods, one could argue that holding cash is riskier.

Real Estate

There are many different types of real estate from residential to real estate investment trust investments (REITS). In either case, real estate offers a tangible asset we can touch, investment income, and a history of maintaining and/or increasing value over time.

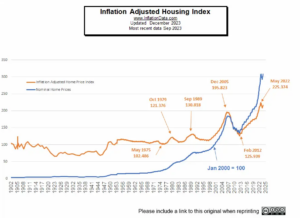

Source: www.inflationdata.com

The above chart shows the inflation adjusted home price index from 1902 to 2024 (orange line).

Gold

My former boss used to say, “an ounce of gold bought a new suit in the 70’s, 80’s, and 90’s. An ounce of gold can buy a new suit today.”

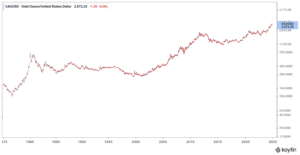

Source: Koyfin

The above chart shows an ounce of gold priced in U.S. dollars.

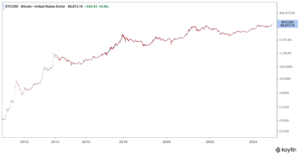

Bitcoin (BTC)

Love it or loathe it, Bitcoin has been a runaway freight train. The “internet money” has been a strong hedge against U.S. dollar debasement since 2011.

Source: Koyfin

The above chart shows Bitcoin priced in U.S. dollars. Bitcoin is a polarizing asset class, but it’s clear those championing the long-term thesis of BTC have been correct.

There is hope to solve our spending issues, which would help rein in these destructive secular trends we have outlined.

Dr. Eli David points to Argentina as a great example — “In under a year, President Javier Milei reduced Argentina’s inflation from 25% to under 3%. This is what happens when you aggressively and mercilessly cut public sector spending.”

We will hold our breath on the Trump Administration’s new Department of Government Efficiency, but at least we have acknowledged the unsustainable path the U.S. is on.

An astute investor may well take advantage of long-term trends that might not change for the foreseeable future. They’d want to consider positioning portfolios to take advantage of government debt levels, higher prices, and the debasement of the U.S. dollar.

Keep in mind, we aren’t advocating you randomly go out and start buying stocks, real estate, gold, and Bitcoin. Your investment personality and risk profile will influence allocation and position sizing.