“The most important thing you can have is a good strategic asset allocation mix. So, what the investor needs to do is have a balanced, structured portfolio – a portfolio that does well in different environments…. we don’t know that we’re going to win. We have to have diversified bets.” – Ray Dalio, Founder of Bridgewater Associates.

There’s a natural human instinct to get rid of things that don’t work. Whether it’s a broken laptop, a rusty old lawnmower, or coffee maker gone haywire, we want the things we depend on to work when needed. It’s easy to apply that logical tree to our investment portfolios.

Punting the laggards and adding to the winners seems reasonable, right?

Not exactly. In fact, proper asset allocation just about assures something in your portfolio will be underperforming. During good times, it’s usually the safe-haven assets that are a drag on performance. To enjoy the benefits of diversification, we must accept this principle.

We would broadly classify a safe-haven as any asset that performs well during market stress. A novice investor might question their existence in good times. An experienced investor knows they are crucial to avoiding catastrophic portfolio losses. A middling investor (who knows just enough to be dangerous) might be tempted to “game the system” to squeeze a few extra percentage points of return. For example, investing in lower quality, high-yield bonds instead of AAA rated bonds or using dividend paying stocks as a bond substitute. We have coined this behavior as turning safe into risky and it usually doesn’t end well. In other words, you will be stuck with assets that behave much like your riskier equity holdings.

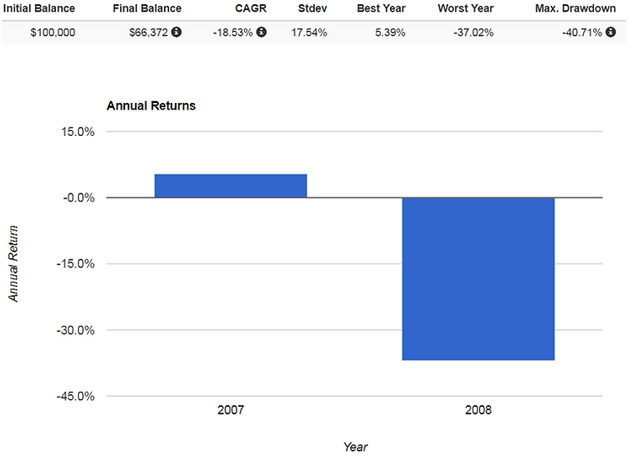

In a disruptive market, true safe-havens are likely to make the experience much less painful. Look no further than the Great Financial Crisis (the below returns are from 1/1/2007 – 12/31/2008). We start with U.S. Large Cap performance for a bit of context and perspective:

Definitions:

CAGR – Compounded Annual Growth Rate

Stdev – Standard Deviation (Risk)

Max. Drawdown – biggest peak to trough percentage decline

U.S. Large Cap

U.S. Large Cap stocks returned -37.02% in 2008. An initial investment of $100,000 at the beginning of 2007 would have been worth $66,372 on 12/31/2008.

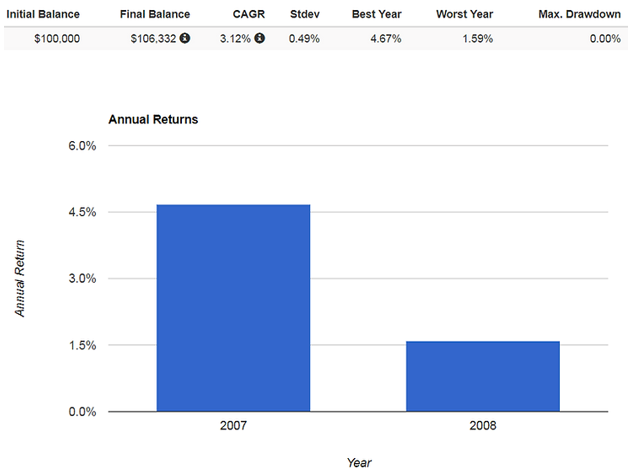

Safe-Haven Assets

Cash

Cash is the ultimate safe haven asset posting a +3.2% annualized return in 2007-2008.

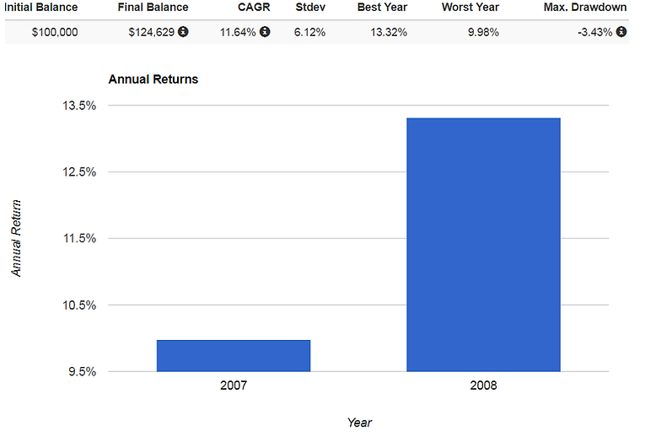

Intermediate (3-7 year) U.S. Treasuries

Even boring U.S. Treasury bonds can produce explosive returns during a flight to safety. Intermediate term Treasuries clipped a +13.32% return in 2008.

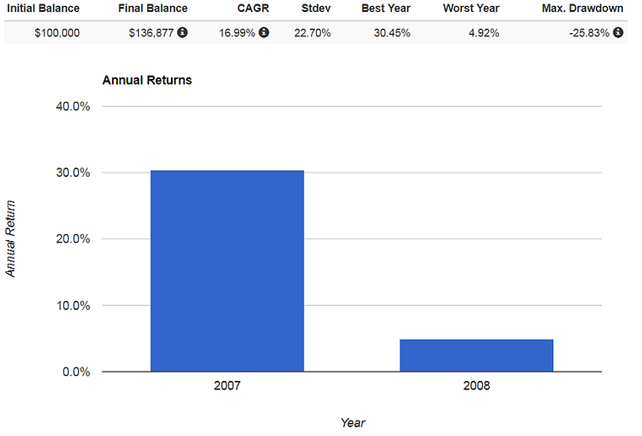

Gold

Gold was the best performing safe-haven asset during the Financial Crisis with an annualized return of +16.99%.

Intermediate (3-7 year) Municipal Bonds

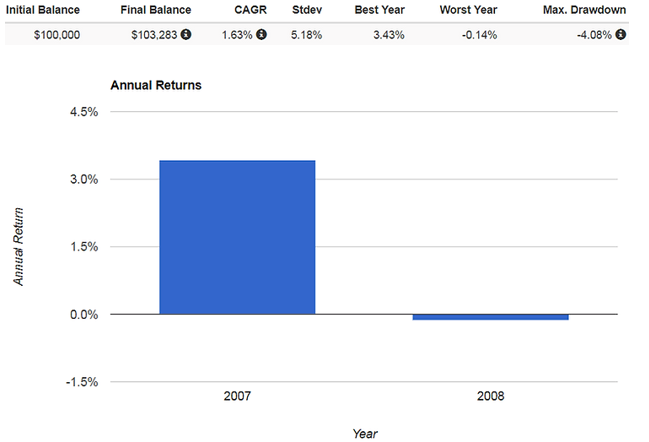

Despite facing stress from decreased income and property tax revenues, municipal bonds provided modest positive annualized returns of +1.63%.

When we mention taking risk off the table or shading to a defensive position, adding to the above safe-haven asset classes is how we implement the strategy in practice. If you’re uncomfortable or worried about financial markets, adding to safe havens could give you piece of mind, allow you to stay fully invested while reducing risk, and not make any dramatic shifts to derail your long-term investment plan. As we have stated many times before, the time to make portfolio adjustments is before something happens.

In a future post, we will outline asset classes or characteristics that give the illusion of safety, but are often fraught with hidden and embedded risks. For example, assets that do not price daily, structured notes, variable annuities, private real estate, non-traded REITs, and obscure alternatives to name a few.

*Graphics were created in the asset back testing feature via portfoliovizualizer.com